All Categories

Featured

Table of Contents

Term life insurance policy is a type of plan that lasts a certain size of time, called the term. You pick the size of the policy term when you first take out your life insurance policy.

Choose your term and your quantity of cover. Select the plan that's right for you., you know your costs will certainly stay the exact same throughout the term of the plan.

Who has the best customer service for Level Death Benefit Term Life Insurance?

Life insurance coverage covers most scenarios of death, however there will be some exemptions in the terms of the policy - 20-year level term life insurance.

After this, the policy finishes and the surviving companion is no longer covered. Joint policies are normally more inexpensive than single life insurance policy plans.

This safeguards the purchasing power of your cover amount versus inflationLife cover is a terrific thing to have due to the fact that it supplies monetary security for your dependents if the worst happens and you pass away. Your loved ones can additionally utilize your life insurance policy payout to spend for your funeral service. Whatever they choose to do, it's terrific tranquility of mind for you.

Degree term cover is terrific for meeting everyday living costs such as family costs. You can also use your life insurance policy benefit to cover your interest-only home mortgage, repayment home loan, school costs or any type of other debts or ongoing settlements. On the other hand, there are some downsides to level cover, compared to other kinds of life plan.

What types of Best Level Term Life Insurance are available?

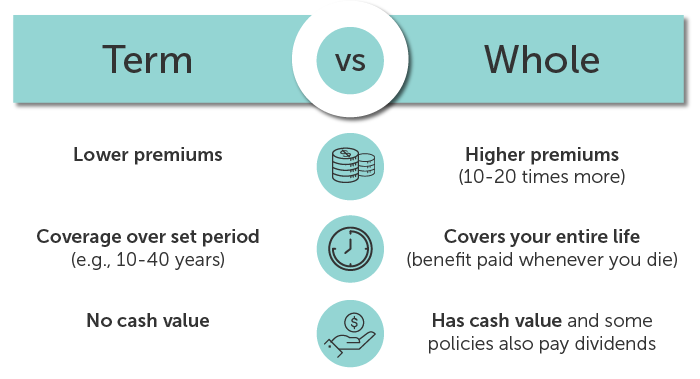

The word "degree" in the phrase "degree term insurance" suggests that this kind of insurance coverage has a set costs and face quantity (survivor benefit) throughout the life of the plan. Merely placed, when people speak about term life insurance policy, they generally refer to degree term life insurance policy. For most of individuals, it is the easiest and most budget friendly option of all life insurance kinds.

The word "term" right here refers to a given variety of years during which the level term life insurance policy stays energetic. Degree term life insurance policy is one of the most prominent life insurance coverage plans that life insurance policy carriers provide to their customers due to its simpleness and price. It is likewise simple to compare degree term life insurance policy quotes and obtain the ideal premiums.

The mechanism is as adheres to: Firstly, pick a plan, fatality advantage quantity and policy period (or term size). Second of all, pick to pay on either a regular monthly or annual basis. If your early death happens within the life of the policy, your life insurance provider will pay a lump sum of death benefit to your predetermined recipients.

Who provides the best Level Term Life Insurance Premiums?

Your degree term life insurance coverage policy expires as soon as you come to the end of your policy's term. Alternative B: Purchase a brand-new level term life insurance coverage plan.

Your current browser might limit that experience. You might be making use of an old browser that's unsupported, or setups within your browser that are not compatible with our site.

Fixed Rate Term Life Insurance

Already utilizing an updated web browser and still having trouble? Your existing browser: Finding ...

If the policy expires before your death or fatality live beyond the past termPlan there is no payout. You might be able to restore a term plan at expiry, however the premiums will be recalculated based on your age at the time of renewal.

As you can see, the exact same 30-year-old healthy and balanced man would pay approximately $282 a month. At 50, he would certainly pay $571. Whole Life Insurance Policy Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 long-term life insurance policy plan, for males and females in excellent wellness.

What should I know before getting Low Cost Level Term Life Insurance?

That reduces the total risk to the insurer compared to a long-term life policy. The decreased danger is one factor that enables insurance companies to bill lower premiums. Interest rates, the financials of the insurance policy company, and state laws can additionally impact premiums. As a whole, firms usually use much better rates at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000.

He buys a 10-year, $500,000 term life insurance coverage plan with a costs of $50 per month. If George dies within the 10-year term, the plan will certainly pay George's beneficiary $500,000.

If he remains active and renews the policy after 10 years, the costs will be higher than his preliminary plan due to the fact that they will certainly be based on his current age of 40 instead of 30. Level term life insurance premiums. If George is diagnosed with a terminal ailment throughout the initial policy term, he possibly will not be eligible to restore the plan when it ends

There are numerous types of term life insurance. The best alternative will depend on your specific circumstances. Typically, most business supply terms varying from 10 to thirty years, although a couple of offer 35- and 40-year terms. Level-premium insurance policy has a set month-to-month payment for the life of the plan. The majority of term life insurance policy has a degree costs, and it's the type we've been describing in the majority of this short article.

Can I get Level Term Life Insurance Premiums online?

They might be an excellent choice for someone who requires temporary insurance. The insurance holder pays a taken care of, level premium for the duration of the plan.

Latest Posts

Family Funeral Policy

Aarp Funeral Insurance

Life Insurance Instant Quote Online Dallas